The crisis in the water industry has put privatisation in the spotlight. It has clearly failed the country and consumers. Opinion is divided on whether the failure is down to privatisation or the failure of “the regulator”. There is a third possibility. The regulators were set into the wrong regulatory framework by parliament for a capital-intensive infrastructure industry. Today it is the water industry in the spotlight. But the electricity and mobile industries are facing eye watering levels of future investment to get their respective infrastructures to where they need to be over the next twenty years.

In each case, when parliament set these new independent regulators their terms of reference, it was too heavily influenced by the economic theory that put the consumer interest as the prime duty above all others (almost the sole duty). That was reasonably interpreted by regulators across the utilities as “today’s consumers” and what today’s consumers want first and foremost are low prices. That has broadly been delivered. But it has arguably been over-delivered in consumers “eating the seed corn” in terms of the industry capacity to invest for the future.

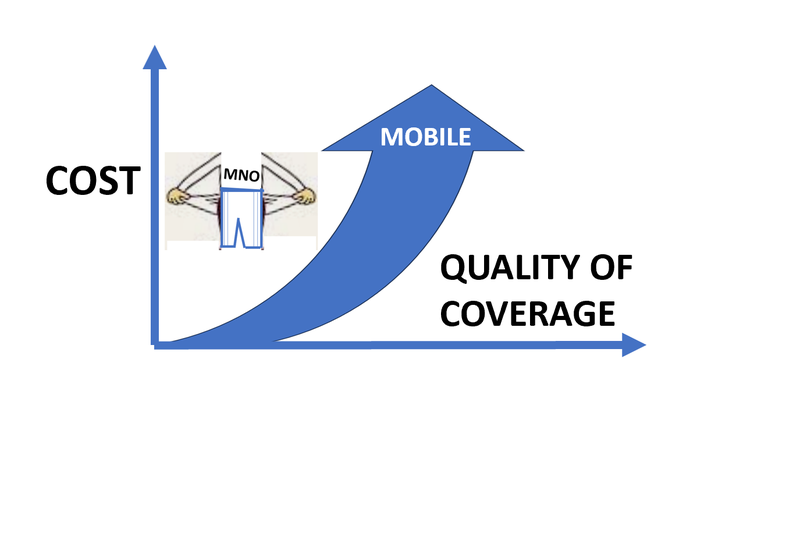

Certainly in the mobile infrastructure case, there was insufficient priority given in setting the regulator’s primary duties to taking care of the consumers needs of 10 year’s hence, who will also want (and need) a far better more resilient infrastructure. That was assumed mistakenly to be a matter for “the market”. This absence of a powerful “infrastructure authority function” has been the fatal flaw in the regulatory model. It has left infrastructure modernisation as nobody’s responsbility. The regulator has the powers but not the duty and the government has been left with the duty but not the critical powers.

The water industry has to invest to stop polluting our rivers and beaches. The pressure on the electricity industry comes from their pivotal role in achieving net zero goals. If the UK is to achieve economic growth the country needs a far higher quality of universal mobile coverage. So we have electricity, water and mobile networks all needing 10’s of billions in investment, the private sector actors with depleted capacity to invest, the national credit card maxed out and consumers in the middle of a cost of living crisis.

Government’s, with their usual focus extending no further than the next General Election will not be able to solve this from Whitehall, even if and when the public finances get into a better state. The only solution is to think really long term (10-20 years) and the starting point is new legislation that adds an “infrastructure authority function” as a new primary duty for all of the regulators (Ofgem, Ofwat and Ofcom). Low prices for consumers remain important for inclusion and high usage but that will now have to be balanced off by a pro-investment regulatory framework that attracts steady but relentless levels of new investment spread over the next 10-20 years. And the regulators will have to better understand their industries and their infrastructures. Knowing the abstract economic theories of markets is no longer sufficient. Regulatory policy must now be infrastructure quality led. The governments must set the long term goals for where that quality needs to be and over what time-scale.

Read more

The pressing need across Europe is for pro-investment mobile regulation. This book describes, for the first time, what a pro-investment mobile regulatory framework might look like.

Casting the Nets provides an unparalleled insight into the great digital transformation of Britain’s communications networks over the period 1984-2004. It gives a graphic description of industrial policy-in-action and brings to life what is involved.

All content here (c) copyright of Stephen Temple